I told you so. I’ve been warning about this for a good while now, and this is only the beginning. In particular, if you are using web-based property management software, you should think about what you are doing. You are putting your own security, your tenants, and your property owners at risk, and probably paying a hefty monthly sum to do it.

I told you so. I’ve been warning about this for a good while now, and this is only the beginning. In particular, if you are using web-based property management software, you should think about what you are doing. You are putting your own security, your tenants, and your property owners at risk, and probably paying a hefty monthly sum to do it.

I’m talking about the huge cyber attack that came in three waves on Friday. If you were not directly affected, it was probably (1) because the hackers didn’t bother with smaller websites or (2) because it wasn’t your turn yet. Here are some of the ones it did affect:

Airbnb

Etsy

Spotify

Twitter

The New York Times

The Financial Times

CNBC.com

Amazon

Netflix

Github

Ladies and gentlemen, these sites are no pushover sites for hackers (or are they?). Supposedly these sites are some of the best secured sites in the world, and hackers managed to get to them all at once. If these sites are vulnerable, how secure do you think your property management software website is? Most of them weren’t even around 5 years ago, and I would venture that none of them have anywhere ‘close’ to the level of cyber security protection of the sites that got invaded.

In a recent NBCNews.com post I saw the comment for consumers to “think carefully about what and when they connect devices to a cloud or even to the internet in general.” In a previous blog, I speculated on a scenario specifically for property managers called “A Day in the Life of a Property Manager Post Cyber Attack”. It is almost scary how real that seems now.

My experience is in property management and I admit it is in my financial interest for people to purchase desktop software. But the reason we have continued to offer on-premise rental property software is because there is a large market of landlords and managers that don’t want to risk their business and their client base. Plus, the monthly fees for web-based software companies are never ending, and will wind up costing a fortune in the long run.

This year, on the Buildium blog (a web-based competitor) it was stated, “Is your company at risk? Basically: yes. Every landlord, property manager, or real estate professional has access to (and stores) sensitive, confidential, personally-identifiable information on tenants and employees.”

And who is vulnerable? Basically everyone, but consider this information from the same blog “Businesses with fewer than 250 employees account for somewhere between 20-30% of all cyber attacks.”

And how easy it to recover from an attack? Read on, “60 percent of small businesses close their doors within months of a successful cyber attack.”

I LOVE technology so don’t get me wrong! We always are looking for new ways to innovate and provide our customers with the best experience possible. But that can be done without storing your valuable data on a remote server that can be attacked at any time. And when that happens, you might suddenly find yourself in an office with no access to your tenants, your owners, your vendors, your accounting, and your customers. And I ask, is that worth the risk?

We hear from our customers how they have been disappointed in many of the web-based products and the lack of support they provide. Many of them migrate back to the Tenant File after trying something else. Call it old fashioned, but we still favor the safety and security of a desktop based program, and the convenience of good customer technical support.

We hear from our customers how they have been disappointed in many of the web-based products and the lack of support they provide. Many of them migrate back to the Tenant File after trying something else. Call it old fashioned, but we still favor the safety and security of a desktop based program, and the convenience of good customer technical support.

Just like buying a new car, you are excited at the possibilities and rewards that you will get with ownership. Unfortunately, just like a new car, someday you’ll have to pay for maintenance and upkeep – it is simply a part of managing property, but there are many things you can do to prepare. Try these rental maintenance ideas and you’ll find it much easier.

Just like buying a new car, you are excited at the possibilities and rewards that you will get with ownership. Unfortunately, just like a new car, someday you’ll have to pay for maintenance and upkeep – it is simply a part of managing property, but there are many things you can do to prepare. Try these rental maintenance ideas and you’ll find it much easier.

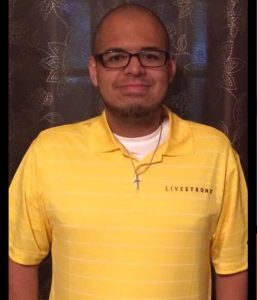

W G Software, Inc. provides an outstanding property management software for owners and managers of rental property, and has been doing so for over 15 years. The software allows users to easily keep track of all the different aspects involved with property management. Currently, the software has several thousands of landlords, property owners, and property management using the software every single day. Wayne Gathright, president, says “I am very excited to have Matthew on our team, and I look forward to seeing what he can bring to the company. I met with Matthew and I knew right away that he was the person that I wanted to work with. I believe that he has the necessary skills and motivation to expand the reach of the Tenant File software for rental property.”

W G Software, Inc. provides an outstanding property management software for owners and managers of rental property, and has been doing so for over 15 years. The software allows users to easily keep track of all the different aspects involved with property management. Currently, the software has several thousands of landlords, property owners, and property management using the software every single day. Wayne Gathright, president, says “I am very excited to have Matthew on our team, and I look forward to seeing what he can bring to the company. I met with Matthew and I knew right away that he was the person that I wanted to work with. I believe that he has the necessary skills and motivation to expand the reach of the Tenant File software for rental property.”