Behind stocks, bonds and cash, commercial real estate has emerged as the fourth largest asset class in the U.S. over the last few decades. Among institutional investors, investments in commercial properties represent nearly 10% of their holdings.

When you look at the typical individual investor’s portfolio, however, there’s often a big hole where commercial real estate is concerned. In fact, for many investors, this particular asset class is a relative unknown. Previously, stiff barriers to entry meant that direct commercial real estate investments were only available to a select group. Fortunately, real estate crowdfunding is making it possible for a broader base of investors to gain access to this valuable segment of the real estate market.

Commercial Real Estate Explained

In the simplest sense, commercial real estate is any property that’s designed to produce income. That covers everything from apartment complexes and office buildings to shopping malls and industrial complexes. Commercial properties generate income in the form of rent paid by tenants and/or appreciation when the property is sold. Investors realize returns based on the property’s income, less any operating, financing and maintenance costs.

Where Does Crowdfunding Come In?

Historically, commercial real estate investments were the exclusive domain of private investors who had the right connections and could afford a five- or six-figure minimum buy-in. Some of the largest institutional investors in the world (including the Harvard and Yale Endowments) have sizable portions of their portfolio allocated to real estate and this has been a major factor in their superior investment performance. Unfortunately, individual investors have historically been excluded from this potentially profitable asset class.

Yearly Archives: 2016

Common Sense Property Management Software

Common Sense Property Management Software

Common Sense Property Management Software

I hear all the time the comment, “I thought my previous software was going to make my life easier, but it just gave me more frustration”. Property management is hard enough by itself without having to struggle with slow software, missing data, constant questions, and a difficult learning curve. We hear from rental property owners every day that are still using spreadsheets to manage their property, or they have purchased a program that is way more than they actually need.

Make sure it works the same way you do

First, if you can’t try out the software before you buy it, run the other way! That is the only way you can be sure it is right for you. When you do try the software, start with one task, such as “I want to charge rent to my tenants”. Then, see how long that task takes. If it is more than 10 seconds, it is too long, even if you have hundreds of rentals. Better yet, look for an option to charge rent automatically without user intervention.

How about this? “I want to update the tenant’s rent amount, and then correct an amount that I accidentally posted to the tenant’s accounting”. Many programs make you navigate to multiple menus to do seemingly easy common sense tasks, so make sure it is easy to correct mistakes.

Other things you might want to look for would be the ability to automatically increase rents on a specific date in the future, the ability to either print checks or transfer via ACH, receive rent online, a way to make automatic payments, and a vendor file that keeps important information on all of the vendors that you work with.

Common sense extras that you might look for would be a reminder system for Owners, Tenants, and Vendors, and a scheduler to help keep track of upcoming repairs, vacations, and notices. You might want to use the reminder to keep track of tenant birthdays so that you can maintain a good relationship with your tenants.

Keep your valuable data with someone you trust – you!

If you keep your own information, it will be safer. Find a program that allows you to make a local backup of your valuable data quickly and easily. It should be as simple as clicking a ‘backup’ button then pressing ‘go’. If not, maybe that software is not for you. Some users prefer web based software, so if that is you, be sure that you can download your important data, and that your valuable information is encrypted and stored on servers with redundant backups. Even then, you could be at risk of a hacker attack that could shut down the servers, so you might consider on-premise software if that is a concern.

Don’t get more or less than you actually need

Another common complaint I often hear is that the customer had previously paid ‘thousands of dollars’ for another complex software, yet they only manage a few rentals. Or, on the other side, they manage over 100 rentals and the software they have is just too limited. Ask the vendor their average number of rentals per user, and the market they strive for. Do they work with owners of rental property or mostly with property managers? You need powerful features in your software without paying too much. At the same time, avoid ending up with overly complicated requirements with features you don’t need.

Common sense assistance

With any new software you need a little help. Avoid companies that don’t provide a phone number or any free support – eventually you will need some assistance. The trend is to not provide phone support, which may mean that you will have to either search a knowledge base for an answer, or wait for a return response to your online support request. Make sure that you can get immediate help through paid phone support.

Follow these common sense guidelines, and your property management software investment will help your business run a lot more efficiently, smoothly, and stress free.

Buy A Rental Property To Pay For College: Save On Taxes And Tuition With No Room And Board

With the cost of the priciest colleges now over $65,000 a year, and room and board costs increasing faster than tuition at many colleges, buying a rental property for your child and a couple of good roommates to live in can be a savvy college funding, tax and retirement move.

You can pick up all of the traditional tax deductions from owning a rental property, hire your child to manage the place and use his net income to pay for tuition with little or no tax, while the rent the roommates pay can help pay the mortgage. When your child graduates in four years, and he will, right? Then you can either hang onto the rental and use it as a retirement home once its paid off, or you can do a 1031 exchange, deferring the tax on the capital gain so long as you buy another “like-kind” property, possibly in a location you prefer to retire to.

Gene Rivers of Tallahassee, Florida, home to Florida State University and a handful of other nearby smaller colleges, is one of the truly outstanding real estate professionals in this country. Gene knows real estate and he knows the real estate business. So it’s no surprise that he is approached by 25-30 parents a year with kids going to one of the nearby universities who want to buy a rental property for their children to live in and rent a couple to some roommates. After all, Gene helped his own son buy a house that his son then lived in with roommates while going to college.

First, Gene says, the young college person has to be responsible enough to screen potential tenants or roommates, do a credit check if need be, sign agreements, collect the rent and not let the place fall apart. “Parents cannot be absentee landlords, Gene says. If your child is not the manager type that’s fine.” You just need to know that going into arrangement to avoid stress for your studying student and yourself. Know who the landlord is and what the responsibilities are.

Click here to view original web page at www.forbes.com

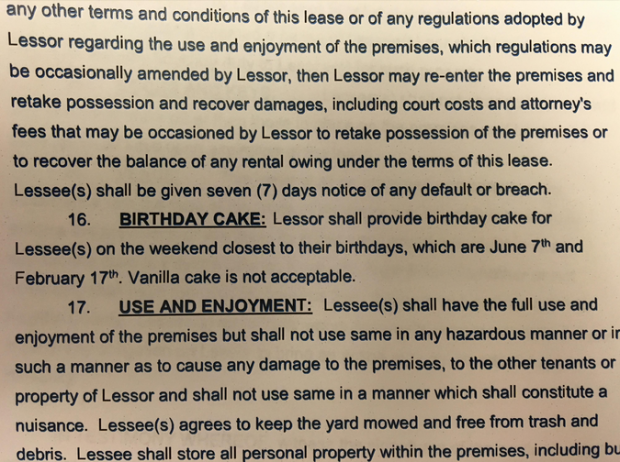

This lease fail is hilarious, but could be devastating to your business …

Before Returning Lease to Landlord, Tenants Say They Slipped in a Secret Clause — and ‘He Signed It’

Property Managers take notice: “Data breach prevention Is dead”

Property Managers should read this important notice from ‘The Hill’. It is a reasoned explanation of why your data on the cloud may not be safe – regardless of precautions and promises from vendors.

It’s time that executives and information security professionals accept the fact that their companies will be breached and start thinking outside the box when it comes to data security. To be in denial of this truth is to not accept reality. Indeed, based on what happened last year, 2014 […]

Top 10 Emerging Trends in the Apartment Rental Process, According to J Turner Research

Landlords, it is helpful to know the current trends among renters. Here is an interesting analysis of how today’s rental market is changing this year and beyond.

J Turner Research examines the top 10 emerging trends in the apartment rental process for 2016. Washington, D.C. —As you prep for an even more profitable 2016, J Turner Research presents the top 10 emerging trends in the apartment rental process that can empower you to increase your closing ratios. […]

Click here to view original web page at www.multihousingnews.com